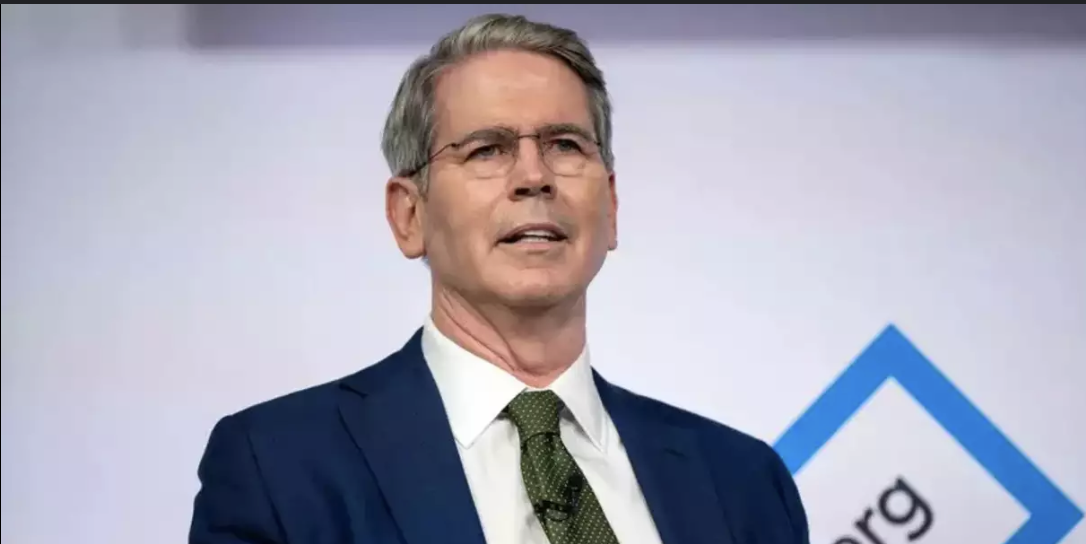

Scott Bessent is a notable figure in finance, known for his impressive career spanning investment management and government service. With a background that includes leadership roles at major financial institutions and a recent appointment as the U.S. Treasury Secretary, Bessent’s influence in the financial world is significant. This article explores his journey, achievements, and the impact he’s had on both the markets and public policy.

Key Takeaways

- Scott Bessent started his finance career at Soros Fund Management, where he played a key role in major investment successes.

- He founded Key Square Group, focusing on macroeconomic investment strategies and achieving notable returns.

- Bessent’s recent appointment as Treasury Secretary marks a new chapter in his career, influencing U.S. economic policies.

- He is active in philanthropy, contributing to various causes and initiatives aimed at economic improvement.

- Bessent’s insights and strategies continue to shape financial markets and regulatory frameworks.

Scott Bessent’s Early Career in Finance

Initial Steps in Investment

Scott Bessent didn’t just jump into high finance; he worked his way up. After getting his education, he started out with an internship with investor Jim Rogers. This gave him a taste of the investment world. He then gained experience at places like Brown Brothers Harriman and Kynikos Associates (working with Jim Chanos). These early roles were important for building his foundation in finance.

Role at Soros Fund Management

Bessent’s time at Soros Fund Management (SFM) was a turning point. He joined in 1991 and quickly became a partner, spending the 1990s there. Eventually, he rose to head of the London office. His work there involved some pretty big moves, including a well-known bet against the British pound in 1992, which made a lot of money for the firm. He later returned to SFM as chief investment officer from 2011 to 2015.

Key Achievements in Early Career

Bessent had some notable wins early on. Besides the British pound bet, he also made a successful bet against the Japanese yen in 2013. These kinds of high-stakes, high-reward moves helped establish his reputation. He also learned some tough lessons. After leaving SFM the first time, he started his own hedge fund, but it didn’t last. He realized that sticking to his investment style, instead of trying to please investors, was important. Here’s a quick look at some of his early career moves:

- Internship with Jim Rogers

- Partner at Soros Fund Management

- Head of London office at SFM

Bessent’s early career was all about learning the ropes and taking calculated risks. He gained experience at different firms, made some big bets, and learned from both his successes and failures. This set the stage for his later ventures and his approach to investment management.

Key Square Group and Investment Strategies

Founding Key Square Group

In 2015, after a successful run as chief investment officer at Soros Fund Management (SFM), Scott Bessent, along with Michael Germino, who previously headed global capital markets at SFM, established Key Square Group. The launch was backed by a substantial $2 billion anchor investment from George Soros, providing a solid foundation for the new venture. Bessent’s departure from SFM marked a significant shift, as he aimed to implement his own vision for macro investing through Key Square.

Investment Philosophy

Key Square Group’s investment approach is rooted in a global macro strategy, using both geopolitics and economics to make investment decisions. This involves analyzing worldwide political and economic trends to identify potential investment opportunities across various asset classes. The firm’s investment portfolio has included positions in oil and natural gas markets, Big Tech, and Big Agriculture. Bessent’s team looks for situations where global events create imbalances or mispricings in the market, which they can then capitalize on.

- Analyzing global political events.

- Studying economic indicators.

- Identifying market mispricings.

Key Square’s strategy is not without its challenges. Macro investing requires a deep understanding of complex global dynamics and the ability to predict how these dynamics will impact markets. The firm’s performance has been subject to market volatility and the inherent uncertainty of geopolitical events.

Notable Investments and Returns

Key Square experienced an increase of 13% in its main fund returns in 2016. However, the fund’s performance declined or broke even from 2017 to 2021. The firm made major gains in 2021, 2022, and 2023. Despite initial success, Key Square faced challenges in maintaining consistent returns, which led to a decrease in assets under management from $5.1 billion in 2017 to $577 million in 2023. The number of institutional investors also declined, from 180 to 20, during the same period. This shift reflects the difficulties in macro investment and the challenges of retaining investor confidence in a volatile market environment.

Scott Bessent’s Role in Government

Appointment as Treasury Secretary

Scott Bessent’s appointment as Treasury Secretary marked a significant shift in economic leadership. Taking office in early 2025, he stepped into a role with immense responsibility, overseeing the nation’s financial operations and policies. His nomination was met with mixed reactions, given his background in hedge fund management and his close ties to the previous administration.

Economic Policies and Initiatives

Bessent’s economic policies leaned towards supply-side economics, focusing on deregulation and tax cuts to stimulate growth. Some key initiatives included:

- A push for reduced corporate tax rates.

- Streamlining financial regulations to encourage investment.

- Negotiating trade deals aimed at boosting American exports.

Bessent’s approach was rooted in the belief that a less regulated market would unleash innovation and create jobs. He often cited historical examples of economic booms following periods of deregulation, arguing that similar results could be achieved in the current economic climate.

Impact on Financial Regulations

One of Bessent’s primary goals was to reshape the regulatory landscape of the financial sector. He argued that many existing regulations were overly burdensome and stifled economic activity. His actions included:

- Relaxing certain provisions of the Dodd-Frank Act.

- Reducing the oversight of smaller banks and financial institutions.

- Appointing individuals with industry backgrounds to key regulatory positions.

These changes sparked debate, with supporters claiming they would boost economic growth and critics warning of increased financial instability. Bessent defended his actions by saying that the goal was to create a more dynamic and competitive financial system. He was preceded in the role by Zixta Martinez.

Philanthropic Efforts and Contributions

Major Donations and Fundraising

Scott Bessent’s philanthropic activities are pretty broad, touching on education, healthcare, and cultural preservation. He’s not just writing checks; he seems to be actively involved in the causes he supports. For example, he opened two foundations back in 2022, which is a pretty big step. He’s also known for his political party contributions, having donated to both sides of the aisle over the years, including a significant amount to Donald Trump’s campaigns. In fact, he even hosted a fundraiser in Greenville, South Carolina, that pulled in close to $7 million for Trump’s 2024 run. Then there was that Palm Beach, Florida, fundraiser he helped with that raked in a whopping $50 million. That’s some serious fundraising power.

Support for Economic Initiatives

Bessent’s support extends to economic initiatives, particularly those aimed at helping underprivileged communities. He’s a supporter of the Prince’s Trust in London and the Harlem Children’s Zone in New York City. These organizations focus on providing opportunities and resources to young people, helping them break the cycle of poverty. It’s not just about giving money; it’s about investing in the future. He also created the McLeod Rehabilitation Center at the Shriners Hospital for Children in Greenville, South Carolina.

Community Engagement

Beyond large-scale donations, Bessent is involved in community engagement. He’s a trustee of the Richard Hampton Jenrette Foundation and a former board member of the Spoleto Festival USA in Charleston, South Carolina. He’s also a member of the Council on Foreign Relations. His involvement in these organizations shows a commitment to preserving cultural heritage and engaging in global issues. He has also supported restoration of the Nathaniel Russell House, a National Historic Landmark in Charleston. He’s endowed three scholarships at Yale: one for students who are first-generation college matriculants, one for students from South Carolina, and one for students from the Bronx. He formerly served on the board of God’s Love We Deliver, an organization founded to deliver meals for homebound people with AIDS.

It’s interesting to see how Bessent’s philanthropy mirrors his investment strategies. He seems to be looking for opportunities where he can make a real difference, whether it’s through financial contributions or active involvement in community projects. It’s a holistic approach that goes beyond just writing a check.

Here’s a quick rundown of some of his key involvements:

- Trustee of the Richard Hampton Jenrette Foundation

- Former board member of the Spoleto Festival USA

- Member of the Council on Foreign Relations

Personal Life and Background

Family and Upbringing

Scott Bessent was born in Conway, South Carolina, in 1962. He grew up as the oldest of three children. His father worked in real estate. Bessent’s family background includes Huguenot ancestry, adding an interesting layer to his personal history.

Education and Early Influences

Bessent’s academic journey led him to Yale University, where he earned a bachelor’s degree in political science in 1984. His time at Yale was marked by active involvement in campus life. He contributed to The Yale Daily News, led the Wolf’s Head Society, and managed finances for his graduating class. These experiences likely shaped his leadership skills and understanding of complex systems.

Public Persona and Advocacy

Scott Bessent is openly gay and has been married to John Freeman, a former New York City prosecutor, since 2011. They have two children. Bessent’s openness about his personal life and family contributes to his public image. He is a prominent figure in finance and beyond.

Scott Bessent’s Influence in Financial Markets

Market Predictions and Trends

Scott Bessent has a history of making some pretty big calls in the financial world. He’s known for his ability to spot trends early, and his predictions often carry a lot of weight. People pay attention when he talks about where the market is headed. It’s not just about guessing; it’s about understanding the underlying factors that drive market behavior. He seems to have a knack for connecting the dots that others miss. Bessent’s insights are often sought after by investors trying to get a jump on the next big thing.

Advisory Roles

Bessent’s influence extends beyond just making predictions. He’s also held advisory roles for various organizations, both in the public and private sectors. These roles allow him to directly shape policy and investment strategies. His experience and knowledge are seen as valuable assets, and he’s often brought in to provide guidance on complex financial issues. It’s a testament to his reputation that so many seek his advice. He’s not just someone who comments from the sidelines; he’s actively involved in the decision-making process. Bessent’s trade policies have been a hot topic lately.

Reputation Among Peers

In the financial world, reputation is everything. Scott Bessent has built a solid one over the years. He’s respected by his peers for his intelligence, his work ethic, and his track record of success. People see him as someone who knows what he’s doing, and that carries a lot of weight. It’s not just about making money; it’s about doing it with integrity and skill. Bessent’s reputation is a reflection of his commitment to excellence. He’s not afraid to take risks, but he always does his homework first. He’s viewed as a leader in the industry, someone who sets the standard for others to follow.

Bessent’s career has been marked by both successes and setbacks, but his overall influence on the financial markets is undeniable. He’s a force to be reckoned with, and his actions continue to shape the landscape of the industry.

Here are some key aspects of his reputation:

- Known for his strategic thinking

- Respected for his market insights

- Acknowledged for his philanthropic efforts

Future Prospects and Legacy

Potential Impact on U.S. Economy

Scott Bessent’s future impact on the U.S. economy is something a lot of people are watching. Given his background in finance and his time in government, his insights could shape economic policy. Whether he continues in advisory roles or returns to the private sector, his views on Trump’s tariffs and market trends will likely influence investment strategies and economic forecasts. It’s all about seeing how his experience translates into real-world impact.

Long-term Vision for Treasury

If Bessent were to return to a role like Treasury Secretary, his long-term vision would probably focus on a few key areas:

- Fiscal Responsibility: Aiming for balanced budgets and reduced national debt.

- Market Stability: Implementing policies to prevent financial crises.

- Economic Growth: Promoting policies that encourage investment and job creation.

His approach would likely blend his understanding of global markets with a focus on domestic economic health. It’s a balancing act, trying to keep the economy stable while also encouraging growth and innovation.

Legacy in Finance and Philanthropy

Scott Bessent’s legacy will likely be defined by his contributions to both finance and philanthropy. In finance, he’s known for his investment acumen and leadership at firms like Key Square Group. His ability to navigate complex markets and generate returns has earned him respect among his peers. Beyond finance, his philanthropic efforts, particularly his support for economic initiatives and community engagement, show a commitment to making a positive impact. His legacy will be a combination of financial success and social responsibility.

Final Thoughts on Scott Bessent’s Wealth

In wrapping this up, Scott Bessent’s net worth is a reflection of his impressive career in finance and government. With a fortune that’s been reported to be at least $521 million, it’s clear he’s made some smart moves along the way. From his time at Soros Fund Management to his current role as Treasury Secretary, Bessent has shown he knows how to navigate the financial world. His journey is a mix of hard work, strategic investments, and a bit of luck. As he continues to influence economic policies, it’ll be interesting to see how his wealth evolves in the coming years.

Frequently Asked Questions

What is Scott Bessent’s current net worth?

Scott Bessent’s net worth is estimated to be at least $521 million.

What was Scott Bessent’s role at Soros Fund Management?

Scott Bessent worked at Soros Fund Management where he became the head of the London office and made significant profits for the firm.

What is Key Square Group?

Key Square Group is an investment firm founded by Scott Bessent after he left Soros Fund Management.

What is Scott Bessent known for in his government role?

Scott Bessent is known for being the Secretary of the Treasury and for his economic policies.

How has Scott Bessent contributed to charity?

Scott Bessent has made major donations and supported various economic initiatives through his philanthropic efforts.

What influence does Scott Bessent have in financial markets?

Scott Bessent is recognized for his market predictions and has a strong reputation among his peers in finance.